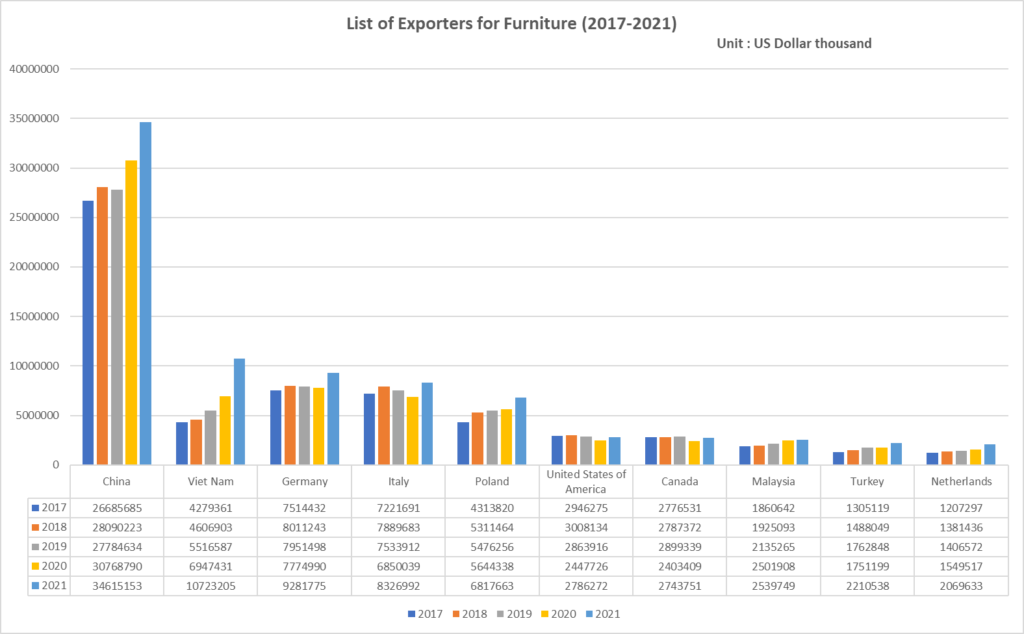

Currently, China and Vietnam lead the market when it comes to furniture export. These years, we have seen some changes in the furniture export. Due to the impact of the new crown, China’s furniture exports fell slightly in 2019. However, China’s total furniture exports and wide range furniture items continue to be the highest. Although the gap is still relatively large, Vietnam’s total exports continue to rise, and there is a continuing upward trend.

Perhaps the total export volume data of the two countries cannot directly affect your decision. However, there are some noteworthy details in it, which will definitely become one of the factors you need to consider.

In this article, I offer a comparison between Vietnam and China concerning imports. I will try to present the current state of the market and predictions. Additionally, I´ll go through raw materials, land prices, low labor costs, tariff advantages, etc.

Raw Materials

When it comes to raw materials, the situation is complex for both countries. Just like other furniture manufacturing countries around the world. Both countries are also facing rising raw material costs.

Wood, metal, textiles, etc., are all essential materials for furniture manufacturing. China’s vast area and well-developed industry have unparalleled advantages in manufacturing. However, in terms of wood, Southeast Asia is rich in forest resources. They have fewer restrictions on logging than China. Vietnam has access to cheaper wood.

In recent years China also faced criticism for deforestation. The furniture industry must go through strict controls when importing raw materials. However, China also invested in materials such as woods and metal, which helped balance things.

Industrial System

As a country that has dominated the market for years, China has an advantage. An excellent industrial system they developed functions well. The reform that took years now provided them with a tool in the furniture market. They still have an advantage in furniture manufacturing and design.

Vietnam still has to build up as a country that rose quickly to dominate the furniture market. The industrial system of the government needs reform for them to step up in the market. They are making small steps towards progress, but significant changes are yet to come.

In the first quarter of 2022, Vietnam’s trade deficit in goods with China was US$14 billion. It is undeniable that Vietnam has to get many parts and raw materials from China as soon as possible to produce furniture. After processing, it is exported to Europe and the United States. It will undoubtedly increase the cost of manufacturing.

Land and Labor Costs

Concerning labor costs, China is more expensive than Vietnam. Take the industrial zone of Ho Chi Minh City as an example. The monthly salary of ordinary factory employees has gone from about 1,500 RMB/month to about 3,000 RMB/month now. However, the advantages are still apparent compared with China’s Guangdong and Fujian.

The land aspect also affects manufacturing costs. Five years ago, the price of industrial land in Ho Chi Minh City was US$60 per square meter, and now it has risen to US$200. Interestingly, although China’s overall land price level is higher, industrial land is not as high as other media reports. Taking Guangdong as an example, it is only 170 US dollars / square meter. In the face of China’s vast land, Vietnam gradually lost its land cost advantage. This is also directly related to the Chinese government’s support for the manufacturing industry and the promotion of employment.

Tariffs

As the U.S. imposes tariffs on China, the advantage of tariffs is highlighted. In 2019, the U.S. government imposed tariffs of up to 25% on almost all home furniture products in China. The tariffs brought on higher costs and then higher prices. In this context, the entire Chinese foreign trade furniture industry began to transfer to foreign countries. In 2020, Vietnam quickly overtook China as the most significant home furnishing supplier to the United States.

On the otherwise, FTAs between Vietnam and major economies reinforce this part of the advantage. The EU-Vietnam Free Trade Agreement (EVFTA), which comes into effect in 2020, will cut bilateral tariffs by 99 percent within a decade. In addition, under the framework of the Regional Comprehensive Economic Partnership (RCEP), Vietnam also has excellent access and tariff advantages for exporting to the US market. Both countries and regions are also major export markets for China. All this limits China’s furniture exports. Therefore, more and more Chinese entrepreneurs choose to build factories in Vietnam.

The trade war between China and the US led to higher costs for manufacturing companies. This, unfortunately, led to a slight economic decline in China´s furniture industry. Consequently, this also caused prices to rise in the US market.

Vietnam profited from the trade war between China and the US. They seized the opportunity to dominate the furniture market. However, they have a long way to go to keep it as China was the leader for years and is still more than a serious competitor.

Covid-19 Impact

Covid-19 affected the entire industry. As the world had to shut down, production was also slowed down. This reflected extensively on the furniture industry as well. The past two years have been a tough test, and only now they are starting to recover. What is important now is how the countries battle with the aftermath of the virus.

Vietnam had a tough time battling the virus. They were forced to shut down many production sites for months to suppress the virus. This affected the furniture industry, causing a delay in export. Vietnam is still recovering from the effects of Covid-19. Unfortunately, the country´s policies have not been as effective. This caused the productivity rate to fall, and their export as well. Fragile supply chains remain a potential hidden danger affecting furniture exports.

China also had a tough time dealing with the virus. Given that China is more experienced and decisive in this area, they have been fighting others longer than others. Thankfully, we´re seeing some progress in the last year.The rapid response and effective zero-clearing policy have made China’s economy less affected. China´s isolation policy helped them get the industry on track sooner. Strong supply chains and government policies allow China to continue supplying goods even when global production is stagnant. This is why they´re currently at an advantage.

In this article, I presented a comparison between Vietnam and China when it comes to imports. Both countries offer different things to the global furniture market.

If you want to have lower-cost furniture, a Vietnam factory might be good. If you want a supplier with better quality and more stable supply capacity, the China factory is more suitable for you. I hope this article gave you an overview of the two countries and their policies. Given that for now, there is a little gap between them on the market, we must wait and see what happens.

Also, I listed the top furniture manufacturers globally, including both in China and Vietnam, hope it helps. Welcome to connect with me if you are confused about how to choose the right furniture supplier.